Victor Tabbush

Victor applies his deep expertise in healthcare economics and his firm commitment to leadership and management capacity building to enable health and social care organizations to develop viable cross-sector partnership strategies.

When contractual arrangements governing a cross-sector partnership are being forged, each partner needs to understand their expected costs and benefits of their participation. As a community-based organization (CBO), you will want your services to return an acceptable net income margin, and the health sector partner will look to receive a good ROI from the payment it makes to you. While projected returns are a vital consideration, there is another equally important one: the division of the risk that the realized returns will differ from anticipated levels. Risk is inherent anytime there is not perfect foresight and predictability.

The partners must assess, divide, and manage this risk, just as they do the returns, in a mutually advantageous way. The key to this is selecting a payment system commensurate with each side’s willingness and ability to accept and control risk.

There are several possible payment mechanisms to be made to you by a health sector partner in return for providing your services in a partnership arrangement. Each mechanism allocates financial risk between the partners uniquely and predictably. Risk means that results can be less or more favorable than predicted. Risk can be one-or two-sided. One-sided risk is when a contract absolves you from incurring any losses, but it provides you with the upside potential to share in any gains. Two-sided risk means that you share in potential losses as well as gains. Whether one or two-sided, the risk stems from two distinct sources: (1) the costs of providing social services may be different than anticipated; (2) the effectiveness of these services in achieving the desired outcomes may be unexpectedly low or high.

The first payment system to be explored that divides risk is Cost Reimbursement. Here you charge the health sector partner for your services at actual cost. The usual formula involves accounting for direct costs plus a percentage add-on to cover indirect costs (overhead). This is a common way for you to receive payment for your services.

The payment is set retrospectively: you charge a knowable fee after the service is delivered, and the cost is calculated. Therefore, there is no risk to you for excessive costs because your reimbursement will cover them. If costs are lower than anticipated, the reimbursement will reflect that too.

In this case, the health sector partner bears all the risk for cost overruns and underperformance. You have no financial incentive to limit utilization nor to curb the unit costs of your services. There is no upside for you as you will not share in any economic payoffs in the form of medical cost savings that stem from your offering. This payment mechanism is not optimal for you nor your health sector partner.

Unlike cost reimbursement, a fee for service (FFS) is a prospective system. The payment is known and set in advance of the service being delivered. For example, a CBO specializing in home-delivered meals may charge a hospital $10 per meal. FFS is a widespread payment system. It possesses some advantages over cost reimbursement.

The health sector partner is protected against unexpectedly high CBO unit costs – unlike the situation with a cost-plus system. While shedding the service cost risk, the health sector partner retains performance risk as it does under the cost reimbursement. Under FFS, it is you that accepts service cost risk. The risk is that the cost per unit is higher than anticipated. Two factors can cause this: 1) the direct (variable) costs could be unexpectedly high; 2) the volume of services demanded by the health sector partner could be lower than expected so that the fixed (overhead) expenses are spread thinly over this smaller volume.

There is more upside potential for financial rewards accruing to you under FFS than in a cost-reimbursement system because the fee, to the extent that it is set above its costs, can enable you to earn a margin of profit.

Another mechanism is for you to provide services with the rate negotiated on a case instead of a service basis. Undertaking a case rate may require you to provide different services and a variable amount of each. For example, if you agree to provide a care transition service for a patient discharged from an acute care facility, that transition can be considered a case. The transition may be of varying complexity requiring varying service offerings (home-delivered meals, transportation, medication reconciliation, etc.) and varying levels of service intensity (more or less of each service).

Under a case rate setting, you assume more risk than under FFS. In addition to the service cost risk, you are also accepting (and the health sector partner is shedding) service intensity risk. Service intensity risk results from the possibility that the care transition requires an expensive service mix and intensity to be delivered effectively. The health sector partner does not compensate you for providing more services than expected. You can mitigate the risk by limiting the population you serve – avoiding clients that involve high costs, or alternatively negotiating higher rates for more expensive cases.

Under this system, you can reap financial rewards if you are skilled at providing cases (i.e., successful transitions) at a cost per case less than the case rate you receive. You have an incentive under a case-based system, unlike under the FFS system, to control service utilization and lower the costs per case. The acute care facility that pays you for the transitions gains nothing from your efforts to curtail unnecessary utilization of services. You are now incentivized to take responsibility to control costs. With that responsibility comes more financial risk and commensurate financial rewards to the extent that you are successful.

Besides the systems described above, there is a different approach to distributing returns and risk. The system is called gain sharing and is often a feature of value-based payment systems. In this approach, you get paid a portion of all your revenues retrospectively – based not on the volume of services or cases you provide but instead on the cross-sector partnership’s success in achieving financial gains. The value measures the gains the partnership creates. Value creation is the difference between the benefits – medical cost avoidance that the provision of social supports causes – less the cost of the provision. Gainsharing creates greater alignment between you and your health sector partner since both of you are now at risk for fees and performance. Partnership returns depend on how well the services perform and how efficiently they are provided. However, if revenues depend exclusively on performance, you will absorb a high, and most likely unacceptable, level of risk. So, to align goals, provide appropriate incentives, and divide risk so that the division is acceptable, you and your health sector partner need to consider a pure gain sharing model variation (i.e., a hybrid scheme). A hybrid scheme is when you receive revenues from a combination of fee-for-service and gain sharing payment.

You could request a stipulated payment from the health sector partner for each unit of service delivered and agree to accept two-sided risk based on how successful the service is in reducing medical utilization. You will bear no risk of not receiving a fee-for-service payment. It only puts the incentive payment at risk. Under a two-sided system, if the partnership incurs losses, you are penalized. There is still some risk involved for you under this two-sided hybrid system.

You can reduce your risk from a hybrid system if you engage in a one-sided risk system. You can participate in this value-based payment system with a manageable degree of financial risk. For example, you are guaranteed at a minimum to receive a FFS payment in hybrid, one-sided arrangements. Furthermore, you have no risk for any performance-related losses but retain upside potential. Because it is insured against losses in a one-sided contract, you will have to accept a lower upside potential than would govern a two-sided arrangement.

You must understand what you are assuming risk for and how to manage these factors in the context of commercial arrangements with health sector partners. Equally important, you must adopt the health sector partner’s perspective by identifying the sources of risk they retain.

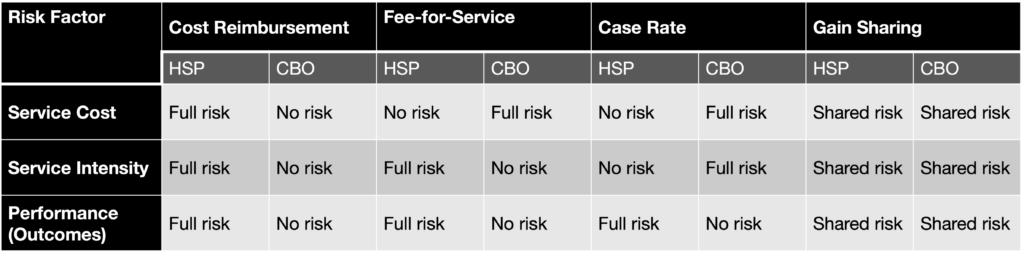

The following table summarizes the factors that give rise to financial risk and how that risk is allocated differently between you and the health sector partner.

Table 1: Division of Risk by Factor & Payment System

CBO: community-based organization

HSP: health sector partner